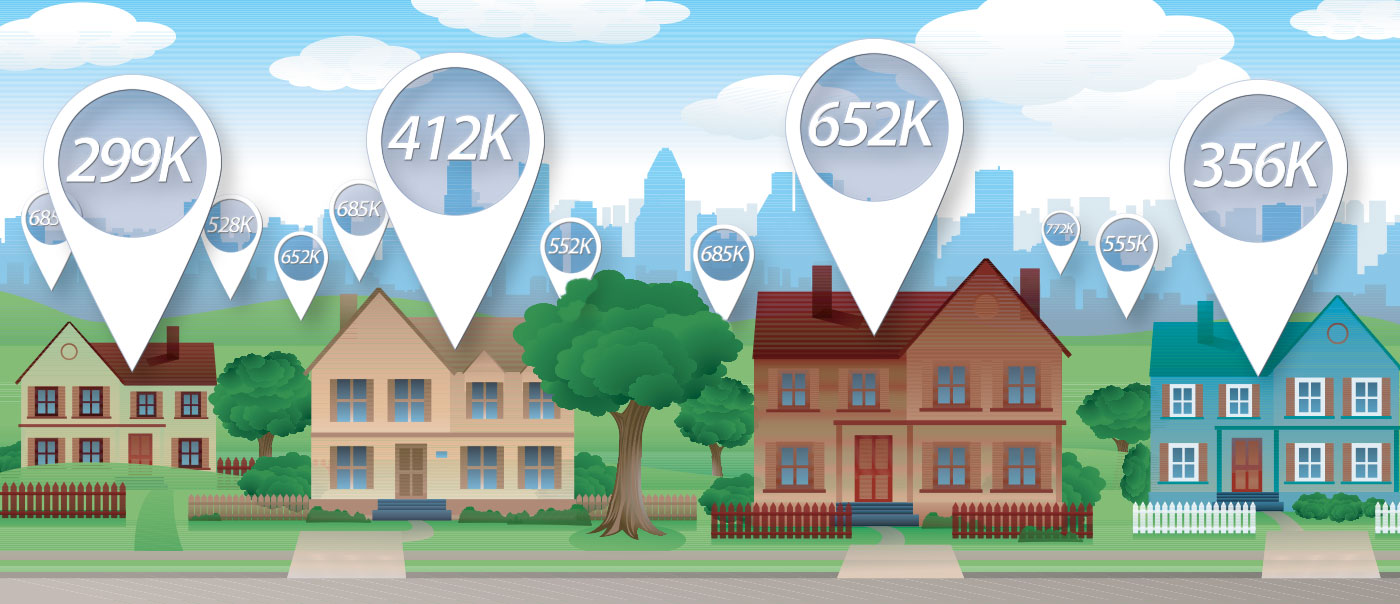

Because all real estate is local, home prices can vary widely across Canada. REALTORS® often use average prices because they’re easy to calculate: simply divide the value of homes sold by the number of sales. The result is an “average” price that can be compared from one time period to another and across housing markets.

While this sounds simple enough, it actually isn’t. The problem with using averages to gauge price levels or changes is that extremely high value home sales distort calculations.

Imagine 10 people are at a bar, each of whom earn an annual income of $50,000. There’s no variation in their incomes and the average annual income for the group is $50,000.

Now suppose Mark Zuckerberg, CEO of Facebook, sits down at the bar and his annual income is, say, $1 billion. The average annual income for the group of 11 is now $90,954,545 – yet no one’s individual salary has changed. The average is still statistically correct, but misleading and/or misrepresentative.

Similarly, when the number and/or proportion of home sales rises in three of Greater Vancouver’s most expensive neighbourhoods (namely, West Vancouver, Richmond and Vancouver West), the national average price climbs (all other things being equal). However, that doesn’t mean selling prices have climbed in other neighbourhoods.

As the chart above highlights, from May 2008 to January 2009, home sales in these three neighbourhoods dropped by 72%, contributing to a drop of over $43,000 in the national average price. As home sales there rebounded from March to October 2009, the national average price jumped back up by $52,000.

Between April and August 2010, sales again dropped in these neighbourhoods, after CMHC introduced tighter mortgage regulations. This contributed to a decline in the national average price. Fast-forward to early 2011 (January to May), when home buyers in these neighbourhoods advanced their purchasing decisions to beat further mortgage regulations, and the national average price rose. It then subsequently declined between May and December 2011 as sales in these three neighbourhoods dropped once the regulations took effect.

More recently, due to a surge of activity in the Greater Vancouver market between August 2015 and February 2016, the national average price climbed by more than $70,000. However, between February and October 2016, the national average price slipped by just $21,000 as home sales in these neighbourhoods decreased by over 71%. The smaller decline in the national average price reflected rising sales activity in the Greater Toronto Area, where the proportion of national sales activity is greater than any other major urban centre and ranks among Canada’s more expensive markets.

It’s difficult to know whether average price changes reflect an actual appreciation or decline in home prices versus changes in the mix of sales. That’s why the MLS® Home Price Index is a far better way of gauging price trends and levels: unlike average and median prices, it isn’t prone to being distorted by changes in the sales mix from one month to the next.