Interest rates are expected to continue to be the major factor affecting Canadian housing markets into 2024 and 2025, according to CREA’s latest quarterly forecast.

Many Canadian housing markets have been quiet since the Bank of Canada’s summer rate hikes last year. Interest rates have been the major factor affecting markets over the last few years, and this is expected to continue to be the case in 2024 and 2025.

Expectations around the timing of the first rate cut in 2024 seem to have solidified to the second half of the year, and financial markets are currently pricing in about 50 basis points of cuts by the end of 2024.

CREA’s March 2024 statistics release, reflected a bounce in new supply around the second week of March followed by a surge in sales in the last week of the month, and a significant jump in listings in the first week of April; giving the appearance the market could be gearing up.

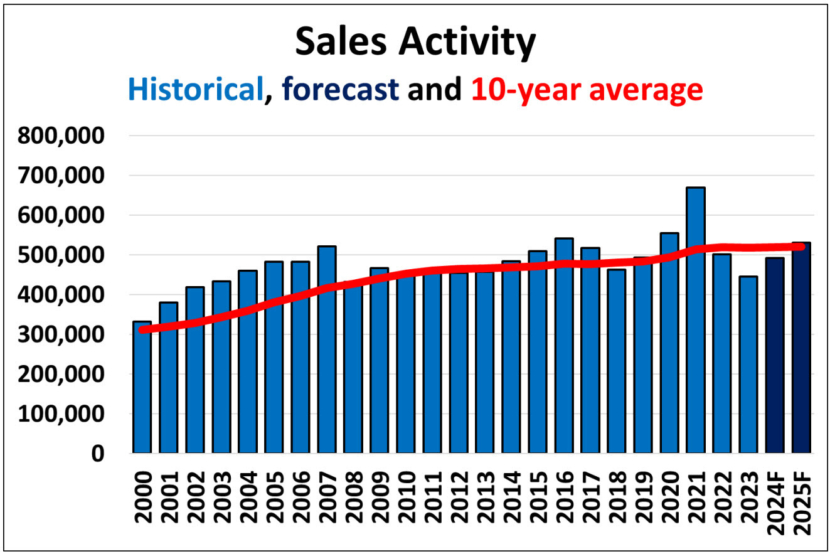

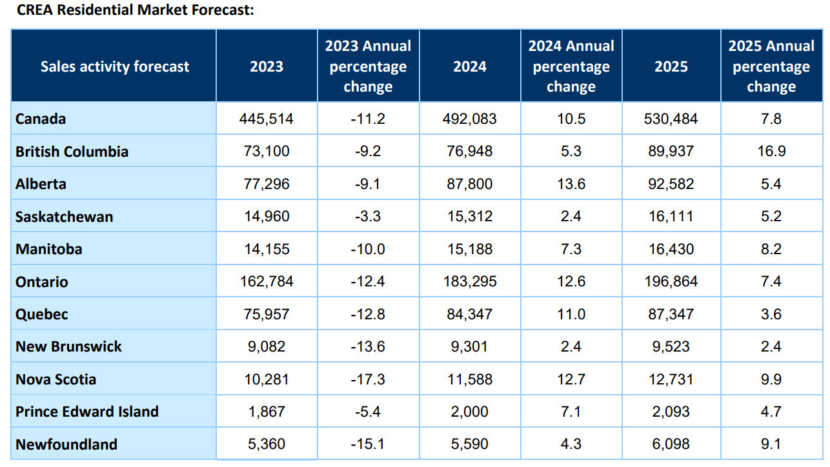

Some 492,083 residential properties are forecast to trade hands via Canadian MLS® Systems in 2024, a 10.5% increase from 2023. This is mostly unchanged from CREA’s previous forecast.

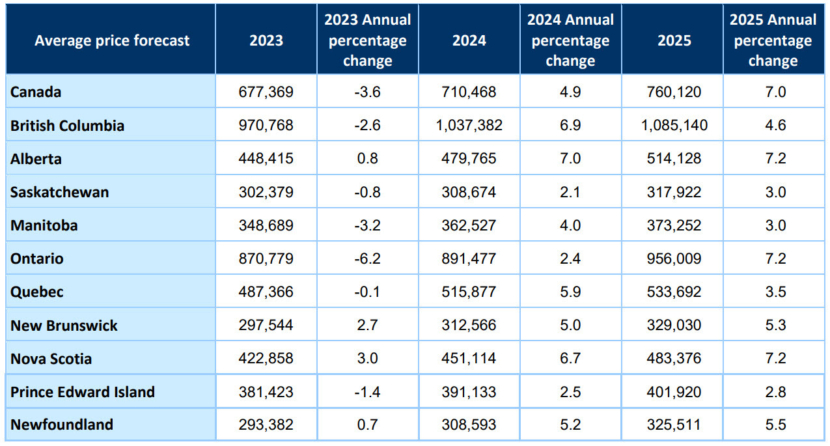

The national average home price is forecast to climb 4.9% on an annual basis to $710,468 in 2024. National home sales are forecast climb another 7.8% to 530,494 units in 2025 as interest rates continue to decline and approach more normal or “neutral” levels.

The national average home price is forecast to rise by 7% from 2024 to $760,120 in 2025.

Each quarter, CREA updates its forecast for home sales activity and average home prices via Multiple Listing Service® (MLS®) Systems of Canadian real estate boards and associations. CREA’s next forecast will be published on Friday, July 12, 2024.