From construction activity to the spin-off effects generated from each home sale, the real estate industry provides significant economic benefits to Canada.

Earlier this year, Altus Group took on research to estimate the impact existing home sales have on the economy in Canada and its provinces.

“Altus Group is a leader in real estate analytics in Canada – the perfect partner for this type of study. This year’s is the sixth edition of the report, the first having been published more than a decade ago, and I can tell you from experience that it is an invaluable resource to have in your pocket when in discussions with policymakers about the importance of the real estate sector to the overall economy.” – Shaun Cathcart, CREA’s Senior Economist

The research finds each home sale transaction through an MLS® System generates close to $76,000 in spin-off spending through fees paid to professionals. This includes lawyers, appraisers, real estate professionals, surveyors, as well as spending on appliances, furniture, renovations, and other items a purchaser may need or want for their new home.

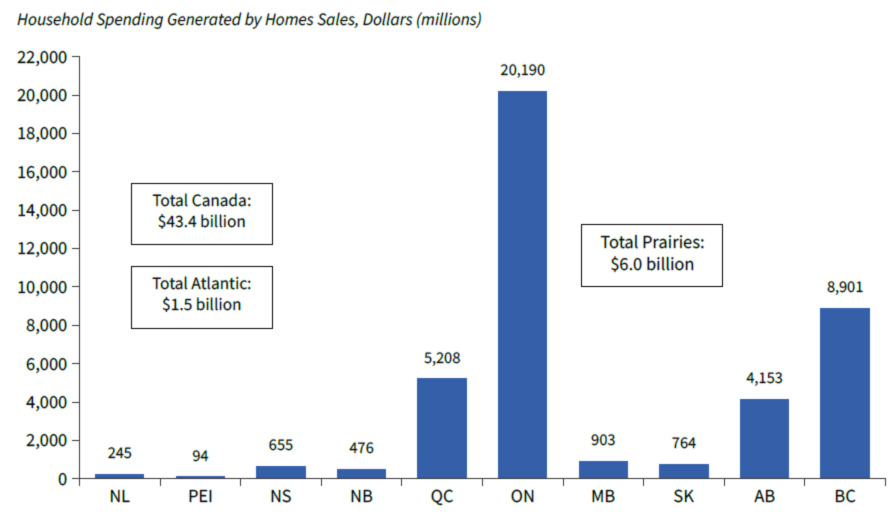

According to the research, each year, there were an average 572,500 new home sales processed through an MLS® System between 2020-2022. Over that three-year period, that adds up to $43.4 billion in additional spending per year generated by transactions that occurred through an MLS® System.

Ontario, being the largest resale market in Canada, accounted for almost half ($21 billion) of that spending.

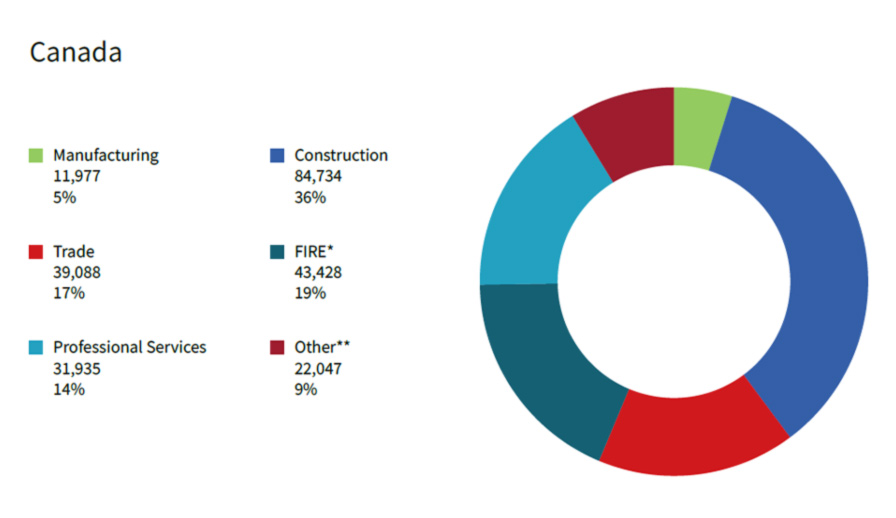

The additional spending also creates jobs directly and indirectly in the economy. It’s estimated there were 233,209 jobs generated each year by the average annual MLS® System resale housing activity in Canada over the 2020-2022 period. Canada-wide, the finance, insurance, real estate, construction, and professional service sectors benefited most from MLS® System home sales.

This resale activity also generated significant revenue for municipal, provincial, and federal governments. Resale transactions through MLS® Systems are estimated to have generated $2.7 billion in municipal revenue through land transfer taxes, and $1.5 billion in federal and provincial sales and income taxes.

Higher interest rates have taken some steam out of the resale market in 2023, which will likely weigh on economic activity this year and next through lower wages and salaries for the professional services that support home sales transactions, and decreased spending on housing-related items and services. It will be an important reminder of how vital the resale market is to the overall health of the economy in Canada.