One day, he woke up and she was gone. She left a note: “I’m leaving you” was all it said.

Sure, their marriage had its ups and downs but that’s true of all marriages, he thought. He never seriously thought she would leave. So when she did, it aroused feelings of disbelief and confusion.

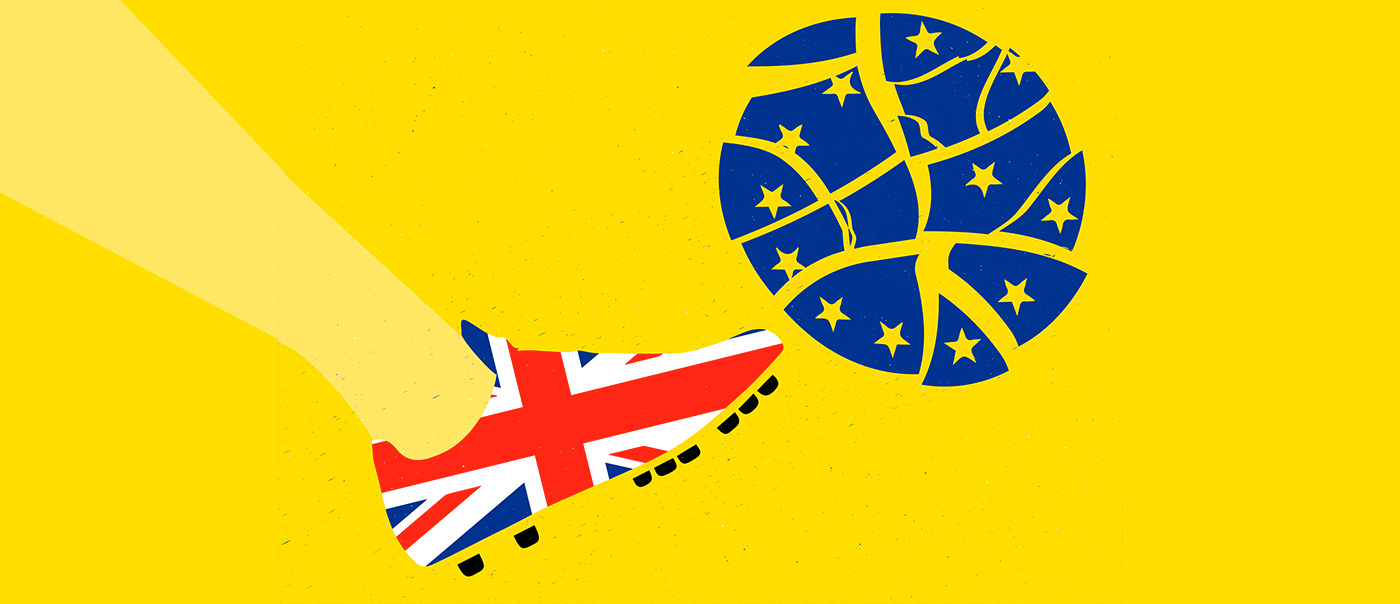

I am of course speaking metaphorically about “Brexit”: that is, the UK’s recent referendum on whether to remain a member of the European Union (EU), which instead resulted in a slim majority (52%) in favour of leaving. Hardly an overwhelming majority.

What exactly leaving the EU means for the UK and EU remains to be seen. There was no prenuptial agreement.

The political uncertainty of it all has spawned a great deal of economic uncertainty. Financial markets hate uncertainty. They reacted by selling off the British pound, which plummeted to its lowest level in 31 years. Stock markets swooned. Oil prices slipped lower amid a weaker outlook for economic growth. The U.S. dollar gained strength as money took flight to the safety of U.S. Treasury bills.

Economists expect the UK to enter a mild recession by early 2017. U.S. economic growth is also expected to suffer due to lower UK demand for U.S. exports thanks to a weakened British pound. Weaker U.S. economic growth is anticipated to translate into lower U.S. consumer demand for Canadian exports.

“What’s next?” is always among the most interesting of questions. Nobody really knows.

“How will Brexit affect economic growth for the EU, U.S. and Canada?” Economists don’t really know that, either (beyond “it ain’t good”).

I could write at least another blog post about how Brexit could lead to another financial market crisis (think late 2008/early 2009), the bottom line for which being that central banks in G7 countries are standing ready to coordinate a response aimed at preventing just such an outcome. Will it work? Add that to uncertainty’s tab.

The only thing that is certain is continued heightened uncertainty. As at the time of writing, financial markets are now betting that U.S. interest rates won’t be going up this year (and some think they may even decline). Prior to Brexit, traders had been expecting one hike (or maybe two) before the end of the year.

And the Bank of Canada? Before Brexit, it had already been expected to keep interest rates on hold until late 2017. Brexit has only cemented these expectations.

The continuation of low interest rates is, of course, supportive for home sales activity– and home price gains in Toronto and Vancouver. The latter are of particular and heightened concern to the Trudeau government, which is considering regulatory measures aimed at cooling them. What might those measures look like? Mr. I Don’t Know … meet Ms. Time Will Tell.