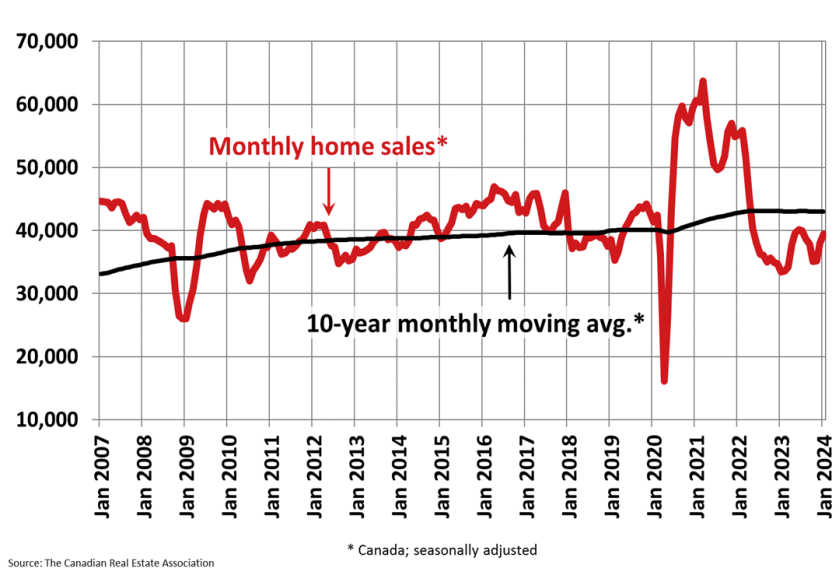

At first glance, seeing January home sales up 22% compared to the same time last year seems eye-opening.

And without context, you’re absolutely correct in raising your eyebrows at that figure. In fact, home sales are up 3.7% between December 2023 and January 2024, building on the 7.9% increase recorded from November 2023 to December 2023.

With home sales rising, prices rising (see video below), and inventory remaining close to the lowest levels since June, it’s easy to think we’re entering a frenzied market.

But, as the Canadian Real Estate Association’s (CREA) Senior Economist Shaun Cathcart says, “there’s quite a bit of noise out there right now, it’s not all signal.”

Let’s get into what that means.

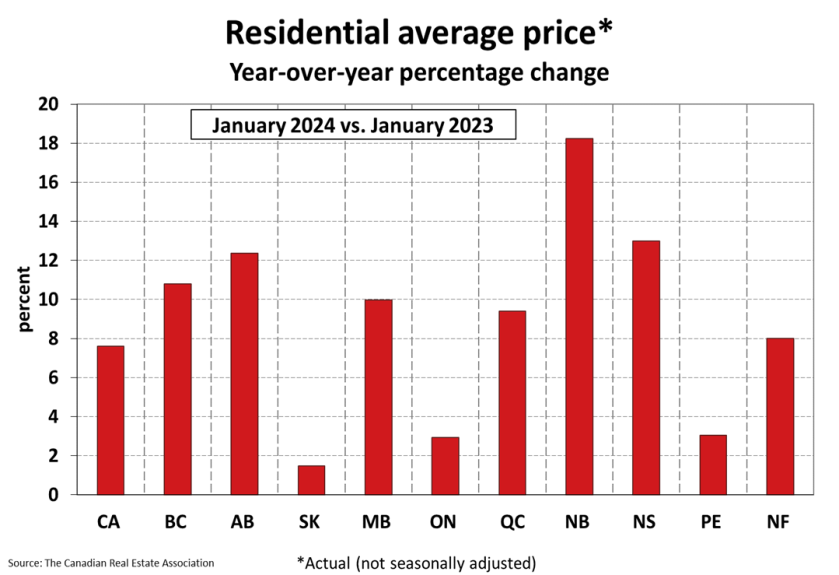

Canada’s average home sale price is up year-over-year

The national average home price was $659,395 in January, according to the latest data from CREA—a 7.6% increase compared to the same time last year. Looking at things regionally, every single province is experiencing price growth, with New Brunswick seeing 18% more sales in January 2024.

However, the average national price is up due to sales, not prices, as sales are bouncing back in more expensive markets like Toronto, Vancouver, Montreal, Hamilton and the rest of the Greater Golden Horseshoe.

“Many of these places have a lot more recovering to do compared to more affordable markets where activity has remained stronger the last two years,” said Cathcart in CREA’s monthly Housing Market Report (available to watch in full below).

“So, it’s not that prices are rising in those relatively more expensive places, it’s that those expensive properties, as they sell in higher numbers, are coming back into the national sample that we derive the average from.”

Simply put: as homes selling in expensive markets outpace homes selling in more affordable markets, the national average will seem to rise, which can skew how the data is interpreted.

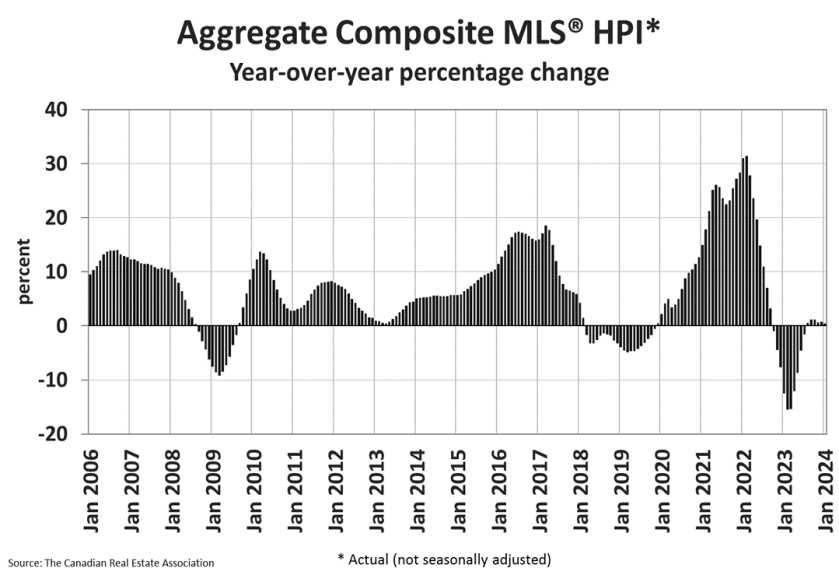

Diving deeper into Canadian home prices

The MLS® Home Price Index (HPI) fell by 1.2% month-over-month, which is an acceleration of the 1.1% decline recorded in December.

But, didn’t we just say the average national price is rising?

“This suggests there’s still some weakness over the past two years that we still must work through,” Cathcart explained, adding Ontario and, to a lesser extent British Columbia, are on the decline, while Alberta and Newfoundland and Labrador are still rising.

Will home sales continue rising?

It’s important to note the 22% year-over-year gain is a direct result of how weak the Canadian real estate market was at the same time last year.

We may sound like a broken record, but the 2024 spring market would more than likely be boosted by a Bank of Canada interest rate drop. Should it choose to do so, Canadians may feel even more confident to re-enter the market and sales could continue to rise.