Each quarter, the Canadian Real Estate Association (CREA) publishes a summary of key economic indicators for commercial real estate in Canada. Housing starts, non-residential building permits, gross domestic product (GDP) and the labour market are routinely monitored by CREA’s economic team as predictors for the commercial real estate market. For residential market information, visit CREA Stats.

Looking at commercial real estate data for the fourth quarter of 2023, we’re seeing a decline in non-residential building permits, housing starts, and the labour market, all evidence of a potential slowdown in construction projects across the country.

Notably, the value of non-residential building permits issued was down almost 3% from the third quarter of 2023.

The housing market also calmed. Factors include many challenges facing the housing sector, such as: higher interest rates, material and labour costs, and high land values.

The labour market showed signs of easing. More people entered the labour force than those who got a job and wage growth is not expected to keep up with the change in the cost of living for most Canadians.

For the commercial real estate market, 2024 remains uncertain as the Canadian economy will have to cope with high interest rates, sticky inflation, a slowing labour market, and affordability concerns.

Here’s a deeper dive into some of the data we’re monitoring on the commercial side of real estate.

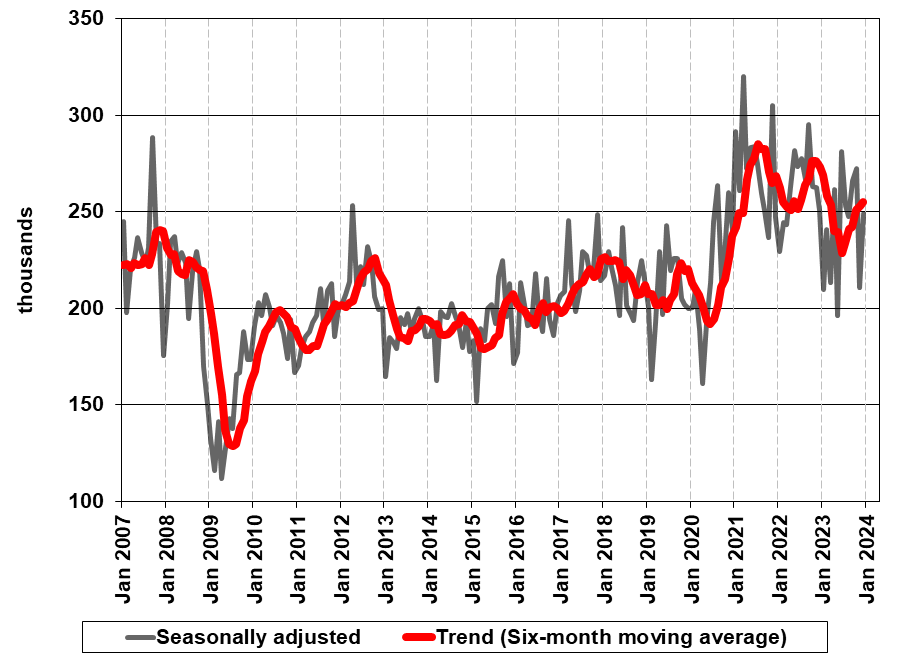

Housing Starts

While still elevated compared to pre-pandemic levels, Canadian housing starts fell by about 4.5% in the fourth quarter of 2023, compared to the third quarter, and was down more than 5.5% from the fourth quarter in 2022.

Affordability issues around the country mean the number of new housing starts needs to find a way to stay high to meet demand, but higher interest rates, material, and labour costs are hampering the development of new homes. Changes around housing policies across all levels of government could help offset some of these higher costs.

The federal government has announced new measures to incentivize the construction of new rental housing, including removing GST from the construction of new rental apartments and requiring municipalities to modernize exclusionary zoning policies to access the Housing Accelerator Fund.

A report by the Conference Board of Canada, produced in conjunction with the Canadian Real Estate Association (CREA), Ontario Real Estate Association (OREA), and British Columbia Real Estate Association (BCREA), highlights that Canada needs to fill 12,000 skilled labour vacancies per year in the residential construction industry over the next decade to meet our country’s housing needs, and non-traditional sources of construction labour will play a crucial role in filling those vacancies.

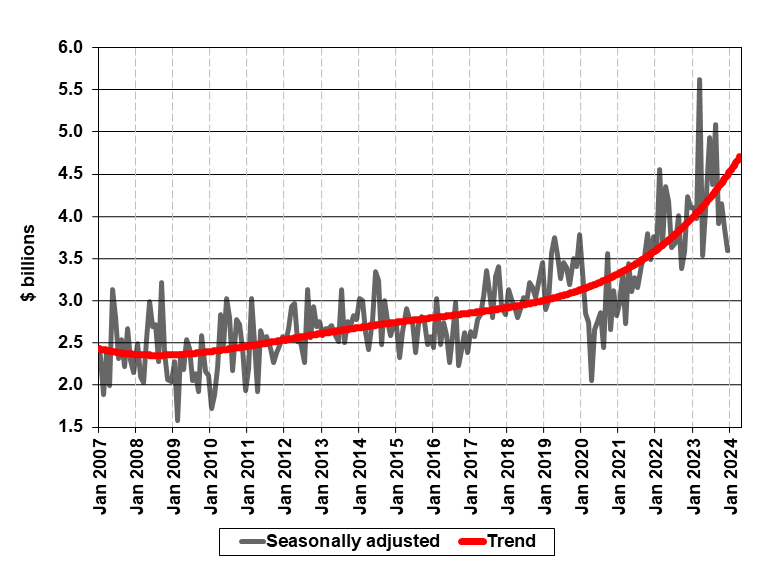

Non-Residential Building Permits

Approximately $11.6 billion of non-residential building permits were issued from October to December 2023. This was down almost 3% from the same three-month period a year ago, and down more than 13% from the three months prior, with sharp reductions in British Columbia, Ontario, New Brunswick, and Newfoundland and Labrador.

All three non-residential components posted quarterly and annual declines in the value of permits. Tighter financial conditions and a weakening economy could further dampen non-residential construction intentions in 2024.

The total value of non-residential building permits posted its worst fourth quarter since 2020 and posted its lowest quarterly level since the third quarter of 2022.

While the number of non-residential building permits issued in the quarter was up on a year-over-year basis throughout the country, they declined sharply when compared to the three months prior in all provinces, except Prince Edward Island. Rising material and labour costs are likely intensifying these trends. As costs continue to increase, the financial feasibility of new projects could be negatively impacted leading to a further reduction in the number of permits issued.

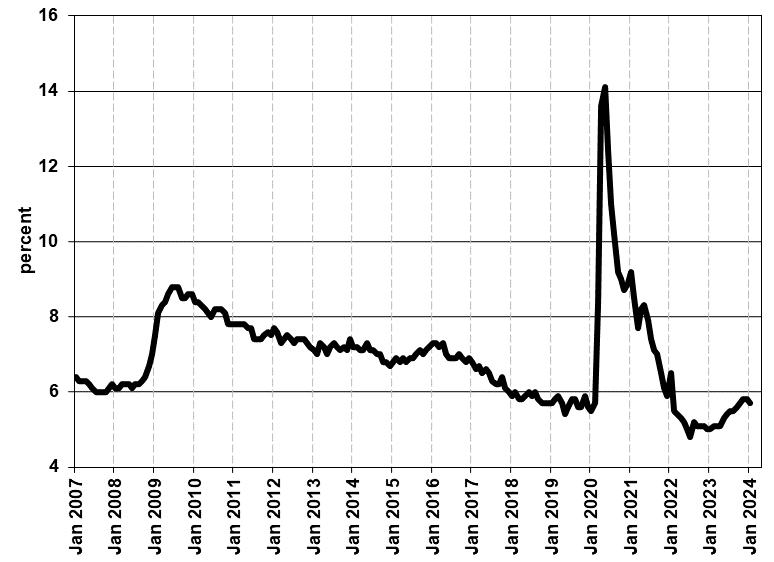

Unemployment Rate

The national unemployment rate in Canada experienced a slight decrease to 5.7% in January 2024 with the Canadian economy adding 37,000 jobs. This was largely driven by an increase in part-time work and suggests that, while more people are finding employment, the nature of these jobs may not provide the same level of income or stability as full-time positions.

Labour market dynamics continue to be influenced by population growth in Canada. However, the employment rate decline in January 2024 is a result of the growth in the working-age population outpacing the growth in employment. This indicates that, while more people are entering the workforce, not all are finding employment, which could lead to potential increases in the unemployment rate going forward.

According to the Bank of Canada’s fourth-quarter 2023 Business Outlook Survey, the labour market is showing signs of easing. Most firms do not feel the need to add new staff and are experiencing less-intense labour shortages than a year ago. However, on average, wage growth is expected to be higher than normal over the next 12 months, mainly a result of cost-of-living adjustments rather than productivity gains.

According to the Bank of Canada’s fourth-quarter 2023 Canadian Survey of Consumer Expectations, workers think the labour market has weakened slightly. However, expectations for wage growth remain high due to cost-of-living adjustments. Most workers still believe inflation won’t return to pre-pandemic levels and could outpace their wage growth.

In their latest Monetary Policy Report, the Bank of Canada has also stated that higher than expected wage growth could keep them from cutting rates in the near-term.

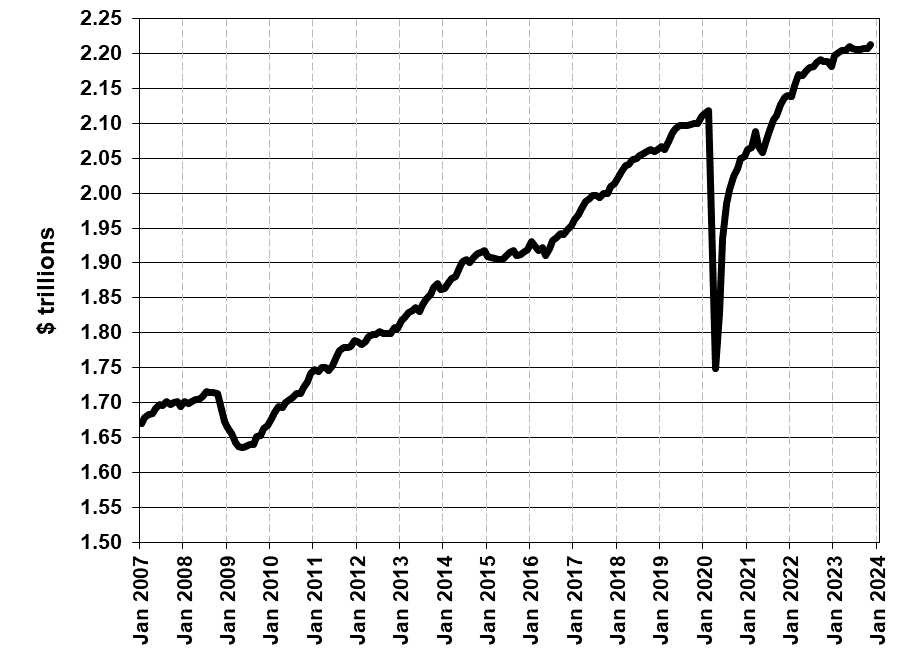

Gross Domestic Product (GDP) Growth

The Bank of Canada held its target for the overnight lending rate to 5% in its rate announcement on March 6, 2024. This was its fourth consecutive hold after two interest rate hikes in the summer of 2023.

The Bank noted Canada’s economy had performed sluggishly over the second half of 2023 and anticipated no growth over the first quarter of 2024 before picking up in the second half of this year. The Bank also stated that “spending by governments contributes materially to growth through the year,” suggesting they will be waiting until the federal government tables the next budget before revising their projections.

While Gross Domestic Product (GDP) growth has been flat since the spring of 2023, real GDP per capita has been stagnating since early 2020, as increases in real output have not kept up with population growth. Recent research highlighted by many financial commentators suggests Real GDP per Capita will continue to trend lower for the remainder of the decade in Canada.

Despite progress on bringing inflation down since peaking in the summer of 2022, uncertainty about what pace inflation may decline over 2024 could keep interest rates higher for longer. In their latest Monetary Policy Report, the Bank of Canada forecasted the Canadian economy is only set to grow 0.8% in 2024, compared to 1% last year, before increasing to 2.4% in 2025. The forecast for inflation shows the Bank doesn’t expect inflation to hit the 2% target until sometime in 2025.

The next CREA commercial snapshot will be available later this spring and cover economic activity for Q1 2024.