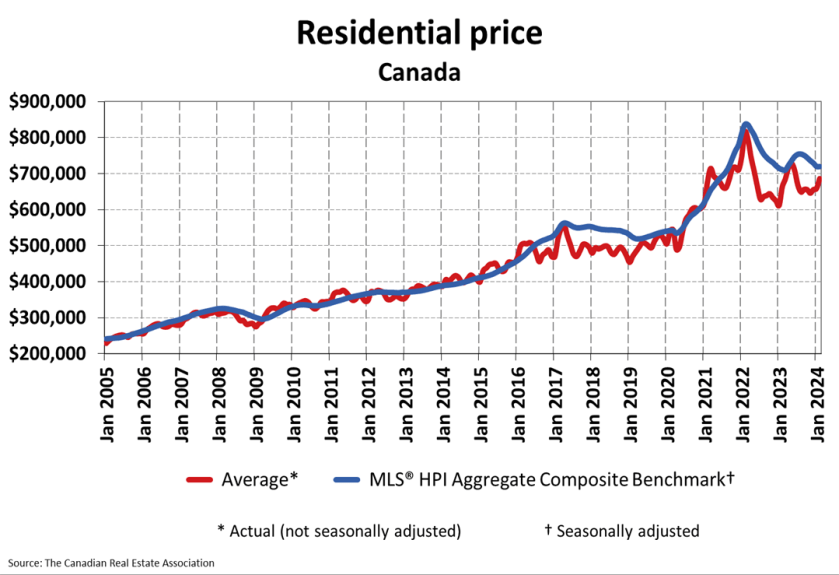

Canadian home prices were unchanged month-over-month in February, but don’t let that fool you into thinking there’s nothing noteworthy going on behind the scenes.

First, to fully understand the current state of Canadian real estate markets, it’s important to note that home prices as measured by the seasonally adjusted Aggregate Composite MLS® Home Price Index (HPI)—the most accurate way to gauge a neighbourhood’s home price levels and trends—had been on a five-month streak of declines.

That ended in February. Sharply. In fact, there have been only three other instances over the past 20 years where an increase (or, “change to the change”) has been that high, leading to the Canadian Real Estate Association (CREA) calling it an “exceedingly rare” move.

CREA’s Senior Economist Shaun Cathcart said all previous instances occurred when pent-up demand was coming off the sidelines—kind of like what we’re seeing now.

Factor in a boom in population, a lack of supply, an expectation of interest rate cuts, and homeowners facing mortgage renewals at much higher rates, and it all points to an “interesting year ahead, moreso than a forecast done in the first week of January could or would ever capture,” said Cathcart in CREA’s Housing Market Report (watch below).

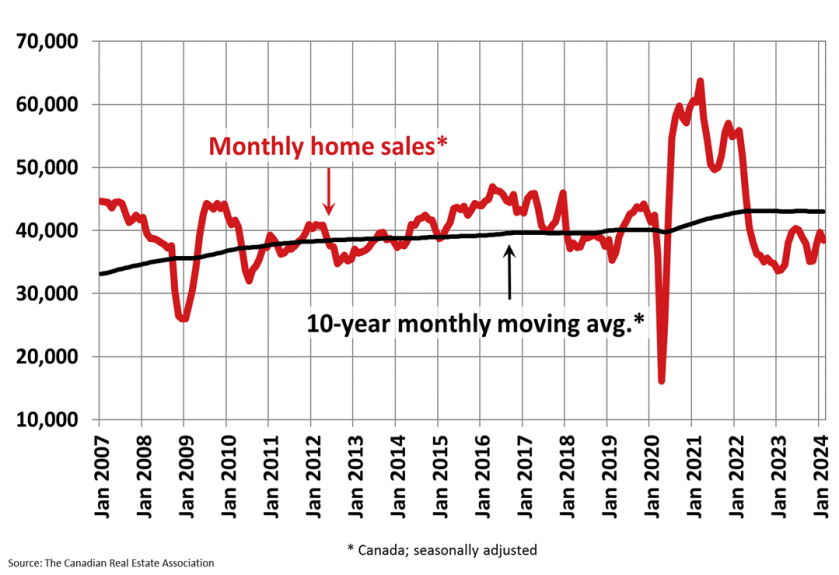

Canadian home sales down in February

After a cumulative 12.7% increase in home sales in December and January, home sales dipped 3.1% month-over-month in February.

Cathcart notes that activity now is still higher than what we saw in a “quiet” fall market last year. Home sales in February were about 5% below the 10-year average for that month, and 19.7% higher than the same time last year.

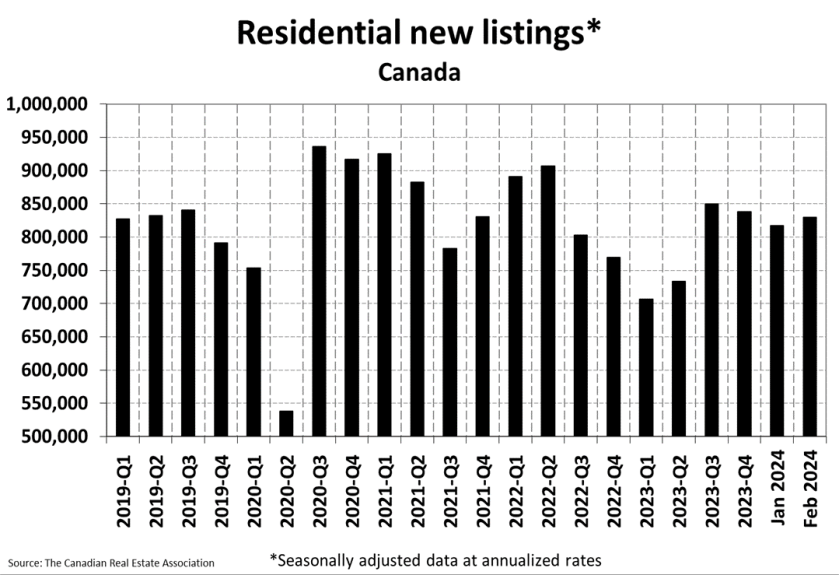

Housing supply not as dry?

Considering we’re experiencing a national housing crisis, there’s a bit of hope that as spring rolls on, more and more Canadians will be listing their homes. We saw a bit of that in February with the number of newly listed homes up 1.6% on a month-over-month basis, helping ease the sales-to-new-listings ratio to 55.6%. (A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions, with readings above and below this range indicating sellers’ and buyers’ markets respectively.)

“After two years of mostly quiet resale housing activity there’s a feeling that things are about to pick up,” said Larry Cerqua, Chair of CREA.

Of course, when talking about housing, the conversation always comes back to interest rates. The Bank of Canada recently decided to keep its policy rate at 5%—the fifth consecutive hold after two interest rate hikes last summer. The belief is when the rate finally goes down, the more confident Canadians will be to re-enter the market.

“At this point, it’s hard to know whether buyers are going to wait for a signal from the Bank of Canada or whether they’re just waiting for the spring listings to hit the market. Either way, neither of those are likely too far off, so if you’re hoping to buy or sell a property in 2024, contact a REALTOR® in your area today,” Cerqua added.

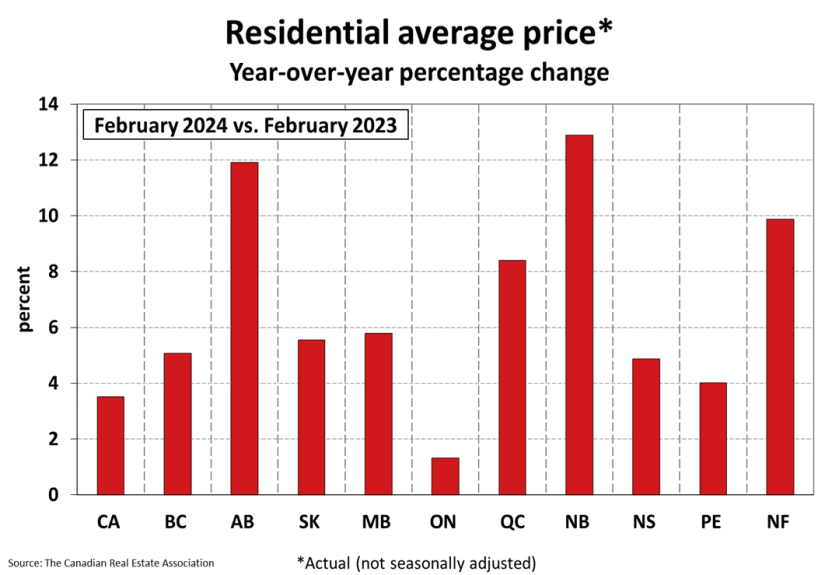

National average prices

The actual (not seasonally adjusted) national average sale price posted a 3.5% year-over-year increase in February, hitting $685,809. Provinces that saw the biggest jumps were New Brunswick, Alberta, and Newfoundland and Labrador.