Since launching in 2012, the MLS® Home Price Index (HPI) has been a go-to source for advanced data on neighbourhood home price levels and trends.

Today, the MLS® HPI continues to grow and is now used by the majority of real estate boards and associations across Canada. As housing market trends evolve, so too does the MLS® HPI. Starting June 1, 2022, the MLS® HPI is changing its methodology for calculating price levels and trends.

What’s changing with MLS® HPI?

The MLS® HPI will shorten the period from which benchmark attributes are derived. As of June 2022, it will use data collected from the previous five-year rolling period. The way benchmark prices are calculated has also changed. Benchmark prices will now be calculated based on current benchmark attributes instead of linking benchmark prices to historical benchmark attributes.

Why was the MLS® HPI methodology revised?

Under the original methodology, the MLS® HPI answered the question, “What would a typical home from 15 years ago be worth today?” while under the new approach it answers the question, “What’s a current typical home worth today?”

More from CREA Café:

- Apples-to-Apples and Home Price Comparisons

- Price Your Clients’ Home with Confidence Using the MLS® Home Price Index

How will these changes improve the MLS® HPI?

When the MLS® HPI first launched in 2012 there were only a few years worth of sales but, over time there has been a large accumulation of data.

As properties are updated and renovated to fit the needs of today’s homeowners, this new method helps ensure benchmark prices reflect those of current housing stock.

Let’s look at an extreme example.

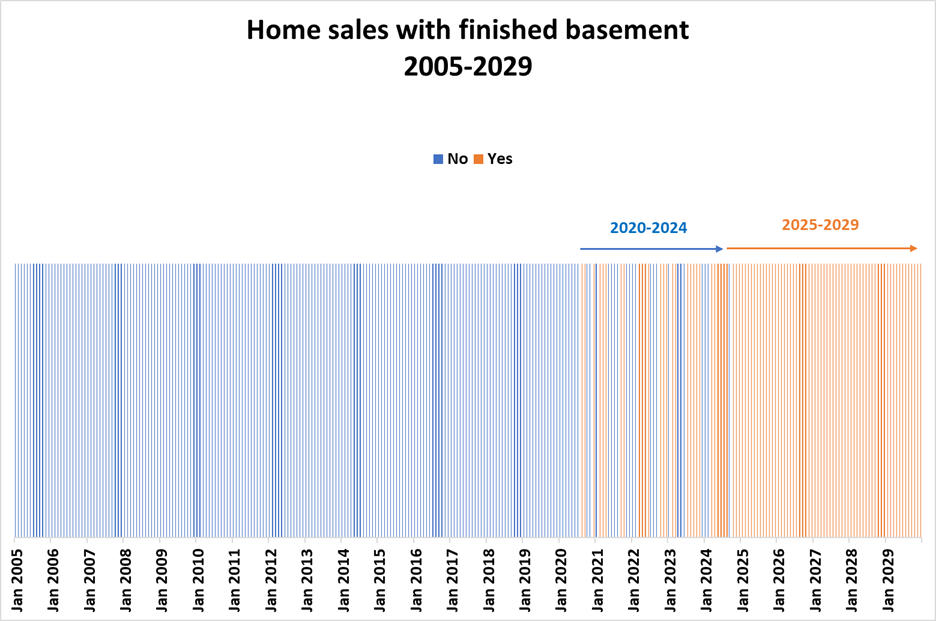

In this hypothetical scenario, from 2005 (the starting point of the MLS® HPI) to 2019 there were no two-storey single-family homes with a finished basement for sale. However, the neighbourhood underwent a rapid transition from 2020 to 2023. Now there are plenty of two-storey single-family homes with finished basements on the market.

However, under the current methodology, the benchmark attribute for a finished basement would still be “no” since most home sales in the entire span of 2005 to 2023 did not have a finished basement.

By the time 2025 begins (as we see in the chart below), all two-storey single-family homes in the neighbourhood have a finished basement. Over the next five years (ending in 2029), all two-storey single-family homes sold in the neighbourhood have a finished basement.

Even though most of the recent home sales have a finished basement, under the current methodology, the attribute for a finished basement for two-storey single-family homes in the neighbourhood would still say “no” because, according to the full range of data, there are still more home sales without a finished basement than with a finished basement.

In this example, members would have to wait until the year 2039 before new sales data in the neighbourhood outweighs the historical data to see a change in attributes. This presents a significant challenge to users of MLS® HPI data who would see these attributes become outdated over time. After a thorough review and consultations, it was decided a five-year period would be optimal.

This shorter window captures more recent changes in the resale housing stock. The span of this window will remain constant but will move forward through time with each annual review.

All benchmark price data going back to 2005 will be recalculated based on the most up-to-date set of attributes to paint a clearer picture of individual Canadian markets.

The result is an improved “apples to apples” comparison that can be applied evenly to all data.

What impact will this have on boards’ MLS® HPI data?

Changes to the methodology will be implemented in sync with changes arising from the annual review to avoid multiple revisions throughout the year.

The MLS HPI® is exclusively available to REALTORS® who want to provide their clients with in-depth analysis they can’t get anywhere else. To learn more about the MLS® HPI, visit crea.ca/HPI or contact CREA’s Member Experience Centre—our team would be happy to answer your questions.

It’s a good move and we as a Realtor will be able to validate our CMA with more and great confidence.