There is a very high level of uncertainty in all markets these days due to the COVID-19 pandemic, and when uncertainty is high it’s good to return to what you know. Which makes this the perfect time to get back to basics and talk about some of the factors that go into determining mortgage rates.

Get ready to brush up on your mortgage knowledge or share this information with your clients.

- Cost of funds

The single biggest factor affecting mortgage rates is the cost of funds. Mortgage issuers borrow money so they can lend it to you. If they charge you more than they are paying to borrow the money, they make a profit. The rate they pay to their depositors and investors is called the cost of funds.

These institutions can lend you money to buy a home because their customers deposit cash into their accounts, sell products like Guaranteed Investment Certificates (GICs), and sell securities in the institutional and capital markets.

When an economy is strong, interest rates tend to move higher. Mortgage issuers borrow money from both Canadian and international sources. Therefore, the state of the Canadian and the other global economies factor into the cost of funds.

During times of economic strength companies want to borrow money to expand their businesses. Mortgage issuers must compete with these companies for investment money by offering higher returns to investors, which in turn raises the cost of funds.

Bank of Canada policy has some relevance when it comes to mortgage rates.If inflation were uncertain and uncontrolled, investors would demand increasingly higher returns on their investments to offset the risk their money will lose value. This would consequently increase the cost of funds.

Interest rates are one tool the central bank uses to keep inflation inside the target range. When the bank sets its short-term lending rate, it impacts the prime rate used by lenders to set variable mortgage rates.

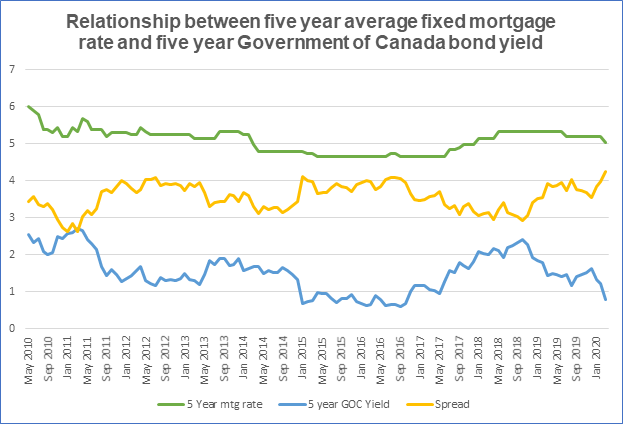

There is a remarkably close relationship between Government of Canada bond yields and fixed mortgage rates. Generally, fixed rates have a positive relationship with bond yields. This means when government bond yields increase, fixed mortgage rates increase, and vice versa.

Government bonds are guaranteed to be repaid—this makes them one of the safest investments available. Mortgages carry more risk because there is a chance the loan will not be repaid. Therefore, mortgage rates are priced higher to compensate for that risk. While the correlation between the two may deviate for short periods, the spread between five-year bond yields and five-year fixed rates typically reverts to its long-term average.

- Mortgage rates depend on several risk fators

Your mortgage rate will always depend on how risky the lender considers you.Your debt ratios are critical factors in your mortgage rate. Most people are familiar with their credit score. It’s used by institutions to determine your creditworthiness. Other factors include:

- Your payments are consistently made on time.

- Your credit utilization rate is below 30%.

- You’ve shown the ability to pay your bills on time over an extended period.

- You have not recently applied for new credit.

- You don’t carry large balances on high-interest credit products.

The combination of these factors results in the mortgage rate offered to you (or your clients, in this case) by mortgage lenders. With the economy struggling and inflation looking to remain low for a long time, the first two factors will cause mortgage rates to also stay low for a prolonged period. For those who have been fortunate enough to keep their finances stable during these uncertain times, low rates will be helpful to their ability to enter the housing market or upgrade to a home that better suits their needs.

For more information on interest rate movements visit CREA Stats.